Enabling Resilient Infrastructure

Risk Assessment | Insurance | Adaptation

Risk Assessment

Insurance

Adaptation

AI-powered Risk Management Platform Purpose-Built for Infrastructure

We deliver localized, asset-specific climate risk analytics that combine physics and machine learning.

Power Generation | Transmission & Pipelines | Oil & Gas | Data Centers | Renewables

Built to Power Smarter Decisions

Our platform is built to deliver precision, resilience, downscaled insights that generic risk models can’t match.

Hyperlocal Climate

Combine causal physics with ML to capture weather extremes and long-term drift

Read MoreDigital Twin

Virtual replica of each asset to model generation, failures, and climate impacts

Read MoreCONTRACT IQ

AI scans complex agreements to expose hidden risk and link obligations to climate impact

Read MoreRisk Outlook

Probabilistic loss curves for damage, downtime, and penalties to guide resilient decisions

The Rising Cost of Climate Risk

In 2023, natural disasters caused $380B in losses exposing a 69% global protection gap

40% of climate-related losses were insured as global warming hit 1.5°C for the first time.

Trillions in new investment are needed to replace aging infrastructure and power an economy.

Building Blocks for Climate-ready Infrastructure

Informed infrastructure decisions with a focus on climate risk, real-time monitoring, and insurance strategy

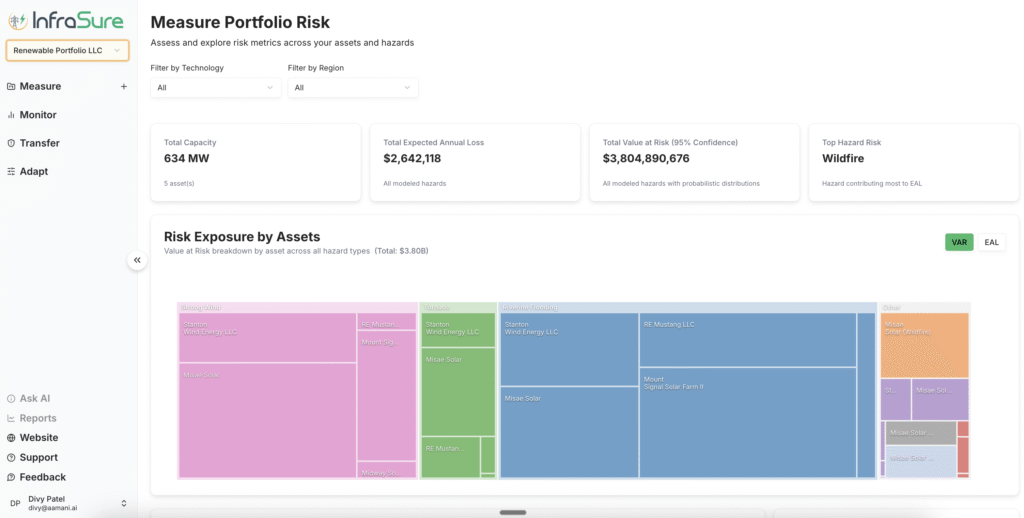

MEASURE

Localized, high-resolution models forecast generation, revenue, and climate-driven losses. We combine physics and machine learning to simulate P10–P90 outcomes and loss exceedance curves validated on historical data.

An AI risk engine reads your project contracts to build a risk matrix, linking legal obligations to financial exposure for a truer picture of downside risk.

- Generation & revenue

- P10–P90 scenarios

- Historical backtest

- Hazard loss curves

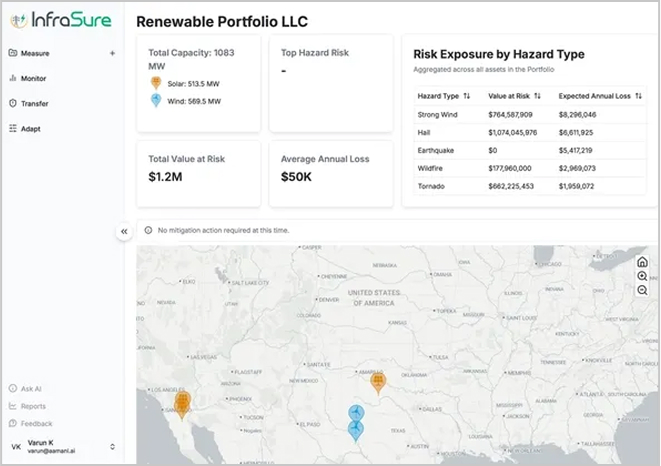

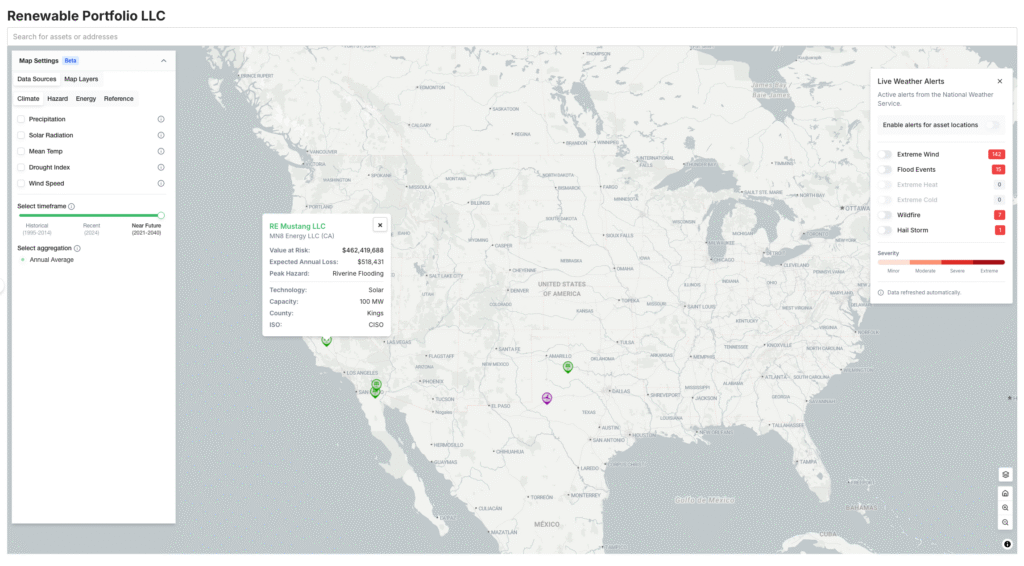

MONITOR

Interactive map for full asset visibility. Track sites, transmission lines, and hazards in real time, with live weather alerts and natural-language AI queries to explore risk and exposure across your portfolio.

Designed to support both operational response and strategic risk oversight.

- Live weather alerts

- Asset risk map

- AI-driven queries

- Portfolio view

TRANSFER

Design and test parametric, index-based, and event-triggered insurance strategies. Instantly see ROI impact, premiums, payouts, and residual exposure to close the protection gap and optimize risk transfer.

Built for underwriters, brokers, and capital providers seeking smarter coverage structures.

- Parametric design

- ROI simulation

- Risk scenario test

- Coverage optimization

ADAPT

Address the risks that cannot be transferred. Plan engineering upgrades and retrofits that harden assets and sustain performance under changing climate conditions.

Supports long-term resilience decisions from early design to operational improvements.

- Resilience planning

- Design upgrades

- Retrofit guidance

- Climate readiness

Purpose-Built for Infrastructure

AVOID

High-risk Projects Early

OPTIMIZE

Insurance Spend and Coverage

PROVIDE

Access to Specialized Insurance Solutions

Purpose-Built for Infrastructure

Can you be a little more creative, meaning that there are two things right one where they say basic residential plan and then the price section.

Optimized & Resilient Assets

- Avoid high-risk sites early

- Select truly climate-ready projects

- Optimize insurance spend & coverage

- Access specialized risk-transfer solutions

Smarter Underwriting

- Turn climate risk into numbers

- Build smarter parametric triggers

- Price and structure coverage

- Close the protection gap confidently

Future-Proof Returns

- Stress-test long-term cash flows

- Set clear data-driven covenants

- Identify downside risks much earlier

- Protect portfolios & enhance returns

From Risk to Resilience

Our most recent pilot demonstrates how InfraSure transforms complex climate science into actionable intelligence—helping stakeholders secure capital, improve coverage, and deliver resilient infrastructure outcomes.

Expert Team Member

80+

Team Member

15KK

Work Have Done

93K

Happy Clients

18K

Awards Wining